747

747

Payroll |Percent of Session Payroll Tiers

Many brands pay their instructors and service providers based on percent of moneys collected for the private or group session/class. This is a means to create a margin or profit for both the service professional and the business itself. In response to this use case, we have updated our Payroll Tier configurations to allow business owners and location managers to assign a percentage of session purchases to be calculated in the payroll report.

- As a business owner, I want to assign 30% of the session earnings as a payroll tier, so that it will calculate for instructor payroll.

- As a business owner, I want to assign a flat rate of earning for sessions paid via unlimited credits, so that it will calculate for instructor payroll.

Click here for Release Notes and instructions for setup.

Payment Log and Invoices are emailed as PDFs

Clients may now log-in to the web view of their client record and easily filter and email themselves PDF versions of the Payment Log and individual Invoices. This becomes a necessary efficiency as more and more clients submit their fitness expenses for reimbursement. Click here for a step by step guide on how to send Payment Log PDFs to clients.

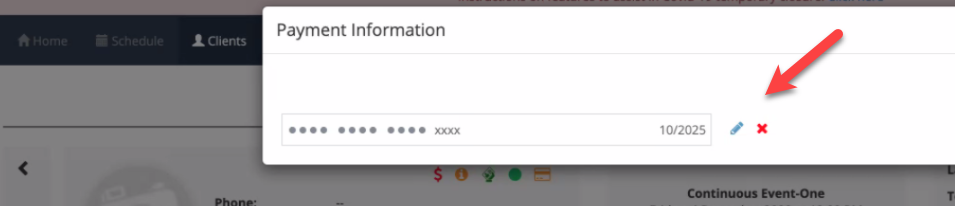

Mandatory Credit Card Edit versus Removal

If a client has any invoice with statuses of ‘Pending/Failed/processing’ then a client's credit card cannot be removed, it must be edited. It is imperative to maintain the connection of your client's payment methods with any outstanding payments they may have on their account, as a result of failed payments or declines. Systematically this means that an Edit to their payment methods is required over a removal and placement of a new one. As such we have the system verify the account and will show only the (pencil) Edit icon when payments are attached to the payment method. The (x) Remove Icon will not be present in these situations, and this is to protect the payment method's Customer ID with the payment gateways.